Since moving to Texas, Elon Musk certainly hasn’t minced words when it comes to his opinion of California. To him, we’ve been “winning for too long,” and we’re starting to grow “complacent” about attracting and retaining big business. And Elon isn’t the only one heading to the Lone Star State—Oracle and HP have signaled that they’ll be joining Tesla in moving jobs to Texas, citing the impact of crippling housing costs on their workforce, among other factors.

The story of a California in decline, as with most stories, is riddled with half-truths, intended to serve particular agendas. Elon’s agenda isn’t so hidden: moving to Texas could potentially save him billions in capital gains tax. Yet it’s worth dissecting the broader trend of slowing population and economic growth in California, and exploring whether people are really moving in droves from the most expensive enclaves of the state—including parts of Los Angeles County—to trendy states like Texas and Arizona.

It’s true that Los Angeles is a changing city. Lots of data and corresponding analysis bears out that demographic shifts in LA mirror broader shifts at the state level—population growth is waning, and Californians are leaving for other states. It’s also abundantly clear that Los Angeles is becoming an increasingly unaffordable place to live. The pandemic caused a brief drop in rents in the denser parts of LA, but home prices rose for the eighth straight year in 2020, and most tenants in LA County are rent-burdened. To understand how these phenomena are interconnected, we need to analyze (1) what these shifts look like at the more granular level of individual cities, and (2) to what extent these shifts are related to changes in housing scarcity.

A quick note about data—this analysis uses microdata samples from the American Community Survey (ACS), a survey sent to approximately 3.5 million addresses every year. The ACS asks questions relating to domestic migration and household income, among other demographic characteristics. We were able to glean insights about the household characteristics of households moving to and from LA County by cross-tabulating migration destination data with other demographic information, such as household income, using IPUMS.

LA County: Where are people going?

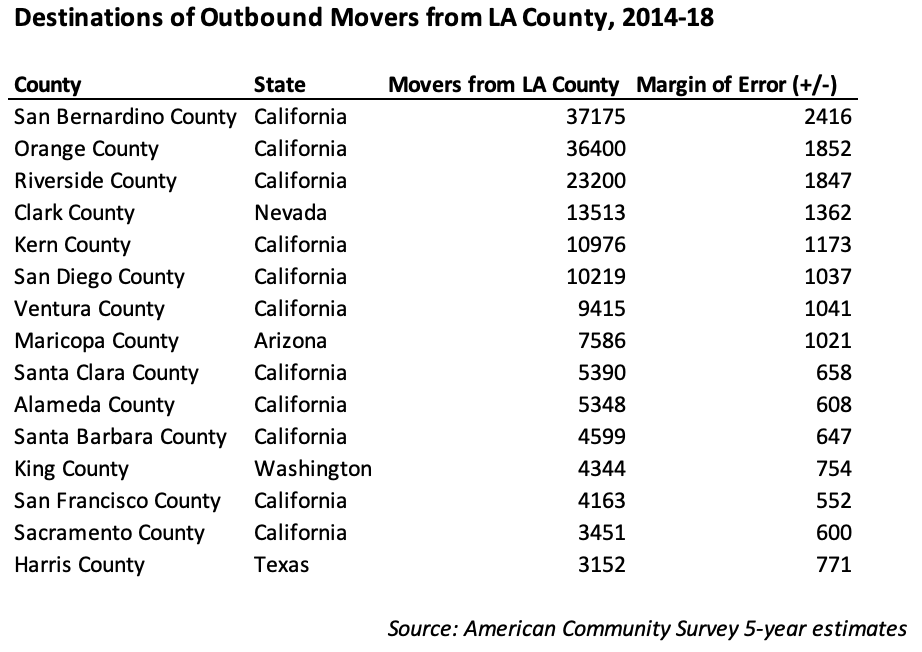

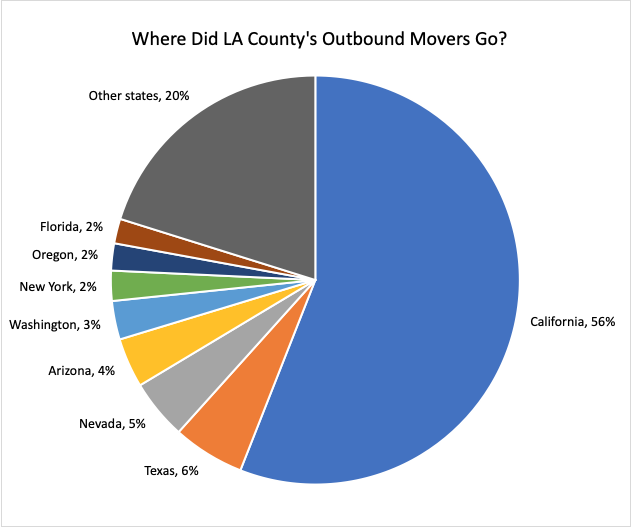

Our first step was to look at county-level trends: when people move away from Los Angeles County, which counties do they move to? Between 2014 and 2018, 56% of households who left LA County moved to other destinations in California. By contrast, just 6% of outbound households left for the Lone Star state. Harris County, Texas (the county where Houston is located and the largest county in Texas by population) was 15th on the list of destinations for people moving from LA County.

Crucially, most outbound movers are heading to the counties surrounding LA—San Bernardino, Orange, Riverside, Kern, San Diego, and Ventura—rather than heading out-of-state, indicating that the majority of outbound Angelenos still desire access to the opportunity-rich job market and cultural hub that is Los Angeles, but cannot afford to live in the county any longer. This parallels the growing trend of “supercommuters” in Northern California, who, priced out of the Bay Area, endure 2-hour commutes from the Central Valley.

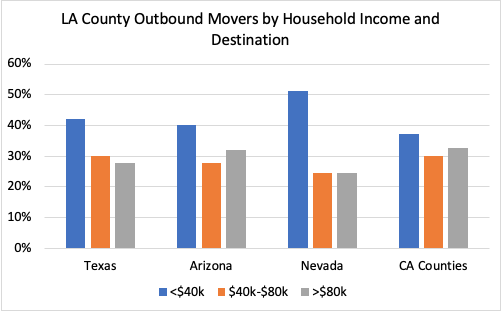

However, moving to a neighboring county isn’t so easy for some outbound movers. Though Texas, Arizona, and Nevada absorb far fewer households from LA than other counties in California, the households moving there earn less on average than households staying in-state. It seems that some are priced out of LA County, and some are priced out of California altogether.

Drawing from ACS household data from 2010 to 2019, the figure above demonstrates that the average household income of LA County movers varies across top destinations. The majority of Angelenos who left for Nevada earned less than $40,000 per year. Households headed to Texas and Arizona were wealthier on average, but, relatively speaking, those who stayed in California earned the most. Note that we included Kern County, San Bernardino County, and Riverside County in “CA Counties” (three of the top five counties Angelenos moved to between 2014 and 2018—see the table above).

This is not to say that there weren’t hot out-of-state destinations for wealthy outbound Angelenos. While over 30% of movers to Harris County, Texas (Houston) had a household income of at least $100,000, the same could be said for 24% of movers to San Bernardino County, and just 16% of movers to Kern County. But on the whole, wealthier outbound households were more likely to stay in California than leave. For most, Texas isn’t so much a tax haven, as it is for Elon Musk, than a refuge for priced-out Angelenos. Staying in California is a privilege in and of itself.

Among LA’s cities, how are things changing at the local level?

We can also explore relative population growth trends within Los Angeles County’s 88 cities for additional clues. While LA County grew by 2.22% between 2010 and 2019, growth among LA’s 88 incorporated cities varied widely. By comparing city growth rates to the county’s rate over the same time frame, we can deduce where newcomers to the county tended to move and where migrating Angelenos disproportionately left from. Here’s a map you can explore with more detail.

Where are newcomers moving, and how are they shaping their destinations?

Several cities stand out as places that have exceeded the county-wide growth rate over the past decade. One big winner is the City of Los Angeles, which grew by 5.1% between 2010 and 2019. The city did get slightly whiter (from 50.6% white in 2010 to 52.1% white in 2019) and higher-income (median annual household income rose from $57,491 in 2019 dollars to $62,142 over the same period). The number of rental occupied units grew by 9%, indicating that the city did add some housing, and the average size of a rental household stayed constant over the same period. But we won’t fawn over the city just yet—the city should have added far more housing considering the sheer number of jobs it gained since the recession.

Pasadena is in a slightly different boat. One of the biggest incorporated cities in the county, Pasadena barely outpaced LA County’s growth rate, and got a little wealthier—between 2010 and 2019, median household income rose from $76,703 to $83,068 (both in 2019 dollars). Yet the city also shed white households—whereas white people comprised 62% of Pasadena’s population in 2010, they accounted for 51% in 2019. Demographic shift in Pasadena is evidently a little more nuanced than in Los Angeles.

Population growth rates in exurban Lancaster and Palmdale have also exceeded county-wide growth rates. These cities have low housing costs relative to the county average, suggesting that the county’s workforce has been increasingly displaced to these working-class exurbs due to the high cost of living closer to work. Palmdale’s population increased by almost 7% from 2010 to 2019, but when accounting for inflation, the city’s median income declined by 3.5% over the same period, indicating that much of the city’s growth consists of lower-income households, victim to a classic case of ‘drive til you qualify.’ It’s worth emphasizing here that displacing households to Lancaster and Palmdale is not a solution to LA’s housing crisis. People who commute from these cities to Los Angeles for work have some of the longest, most painstaking commutes in the state, and by no choice of their own, they greatly exacerbate congestion and pollution.

In addition, there are a few cities whose growth has coincided with significant (yet insufficient) housing construction. As we’ve highlighted in our prior research, Azusa’s housing supply growth between 2015 and 2020 ranked fifth in the county, even though its housing was almost exclusively unaffordable to low-income households. In this context, the city’s demographic changes make a lot of sense. Between 2010 and 2019, the city’s median income grew by 12.4%, and the percentage of white residents shot up from 44% to 53.3%. An even more extreme example is West Hollywood, where the median household income increased by a staggering 22%. West Hollywood is a destination of choice for wealthy movers, causing high turnover in the existing rental stock—in 2019, a whopping 14.9% of renter households had moved to the city in the last year (West Hollywood is second among all of LA’s cities along this metric). Even as the city has become a whole lot richer, unaffordability has worsened; the median percentage of income spent on rent has increased from 30.1% to 31.8% from 2010 to 2019. These cities might have grown, and they may have built some housing to at least try and satiate demand, but affordability is still a pressing concern.

Where are people fleeing, and why?

In the case of stagnant population growth, it’s important to distinguish between places that are comparatively affordable and growing slowly vs. comparatively unaffordable and growing slowly. Systemic racism and disinvestment have depressed growth in many communities of color across Los Angeles, even though these places are affordable for more households. Yet it’s worth considering the rapid demographic shifts that these cities have experienced over the last decade. Cities like Bell have gentrified significantly—in Bell, the white share of the population rose from 58% in 2010 to 79% in 2019—and we’ll gladly point the finger at suppressed housing supply in exclusionary places elsewhere in LA County. Yet these slow-growth cities also have among the lowest rates of housing market turnover (which we measured by examining the proportion of all households who moved in and rented in the past year) in all of LA County. For example, even though most households rented in Lynwood in 2019, only 3.3% of households were new renters. Maywood, Bellflower, and Cudahy are all similar in this respect.

But then there’s the exclusionary cities—the ones we’ve made a habit of criticizing here at Abundant Housing—that are among the most expensive places in the county to live. In contrast to the cities to the south and east of downtown LA, cities like La Cañada Flintridge and Malibu are astoundingly wealthy and would like to keep it that way; in La Cañada Flintridge, the median income was $175,788 in 2019. Yet turnover is also comparatively low in these places, meaning very few people in these places are coming and leaving rental units. By and large, people aren’t escaping these historically exclusionary places because of high housing costs and being replaced by wealthier folks; they are staying and reaping the gains from soaring home values.

But in cities like Hermosa Beach, El Segundo, Redondo Beach, and Beverly Hills, turnover is high, implying that these cities are shedding priced-out renters rapidly. In Hermosa Beach, for example, median household income ballooned by almost 17% between 2010-19 (and that’s adjusted for inflation!) and 15.4% of households were new renters in 2019 (#1 in the county). Together, these figures indicate that new renters typically replaced other lower-income renters. In fact, in Hermosa Beach, the number of occupied rental units declined from 5,110 in 2010 to 4,711 in 2019; it’s impossible to chalk up the rapid influx of wealthy renters to new supply. It is in these wealthy, coastal cities that Angelenos are being priced out, and their homes are being quickly gobbled up by much wealthier households.

Conclusion

All this provides further evidence that people are being priced out of Los Angeles. It’s the entire basis for organizations like Abundant Housing LA, and it’s why the fight for a more affordable and inclusive Los Angeles is so important. Studying demographic shifts at the local, city level illuminates helpful patterns that not only make the dimensions of the housing crisis clearer, but also tell us more about what the crisis’s victims are like. This isn’t really about numbers after all—it’s about real people impacted by very real and very pressing policy problems, left unsolved because of a lack of political will.

But the numbers, as we can make out, tell a compelling story. Movers from LA County are going to a wide range of places, but most of them are staying close to Los Angeles. In most cases, households staying in-state and migrating to other parts of Southern California have higher incomes than households leaving the state altogether. For priced-out Angelenos, staying in California is no easy feat.

At the city level, some cities are growing faster than others—they tend to be supplying slightly more housing, but like slow-growth cities, they are also getting wealthier (and, in most cases, whiter). Exurban cities like Palmdale and Lancaster are outpacing the county-wide growth rate, as they are becoming one of the only financially feasible options for low-income households in the county—a disaster for spatial equity, the environment, and human welfare, especially considering the unresolvable fire hazard in the Antelope Valley. Among the cities that are growing slower, some are sites of vast and ongoing displacement (high costs, low supply, and high turnover)—Hermosa Beach and El Segundo immediately come to mind. And then, predictably, there are those that are simply unwilling to grow at all. La Cañada Flintridge sticks out like a sore thumb, but there are lots of others.

All in all, demographic shifts at the city level are complex and difficult to fully unpack. But popular stories of widespread displacement fail to differentiate between two very dissimilar experiences of those leaving LA. For some, living in LA has become inconvenient—these households tend to stay in California more often. They are most certainly impacted by LA’s high housing costs, but can still afford to stay in the Golden State. But then there are those for whom LA has become unlivable. These households are more likely to leave California altogether, and they get the short end of the stick when it comes to LA’s demographic churn. They deserve our undivided attention, and local officials that attend to their needs—namely, abundant and affordable housing.